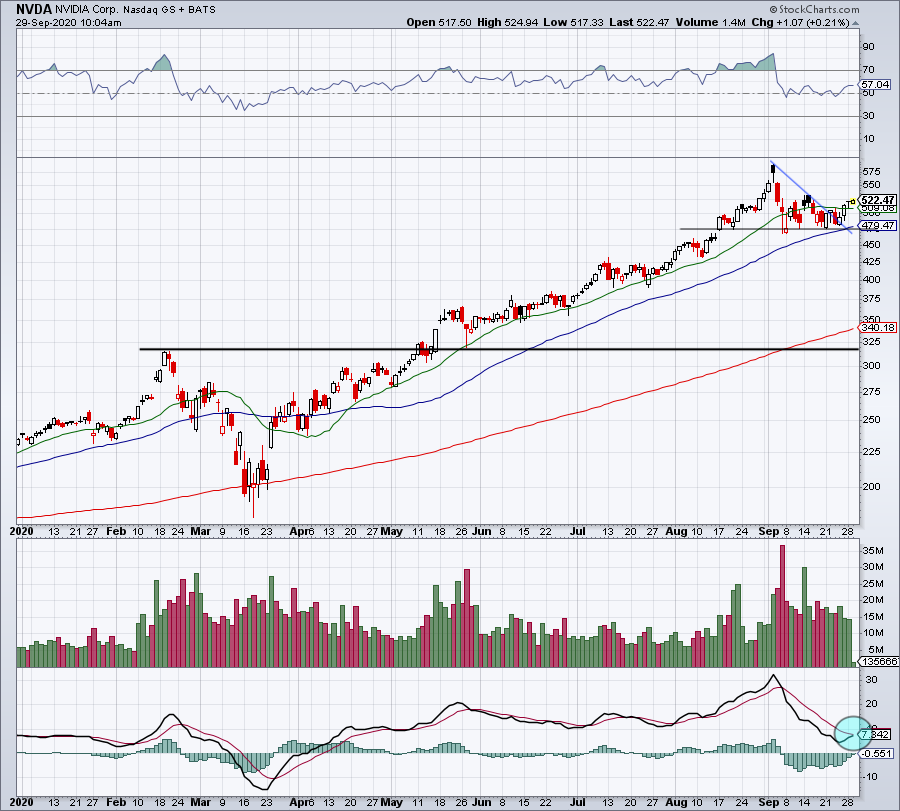

The consumer cyclical sector also saw its weight rise thanks to ( NAS:AMZN) and Tesla ( NAS:TSLA). Last year saw the technology sector's weight within the Morningstar US Market Index rise by 5 percentage points to one fourth of the index. What followed that boom was a decade led by stocks outside the US and value over growth.Īs the pandemic wreaked havoc on many economic sectors, while benefiting many of the largest stocks, how much of an impact did 2020's trends have on the market's profile? As a recently published report looking at changes to Morningstar Equity Indexes demonstrates, equity markets today bear resemblance to the late 1990s. Nvidia's meteoric growth represents a period in which global equity markets were dominated by high-priced technology-related stocks low on dividends, mostly from the United States and China.

As of year-end 2020, Nestle had slipped to the 17th slot, but more tellingly, Nvidia clocked in at number 20 with help from a 122 per cent return last year.

In 2010, Nvidia was the 731st-largest constituent in the Morningstar Global Markets Index and Nestle was the fourth. The past decade belonged to the Nvidias of the world.

0 kommentar(er)

0 kommentar(er)